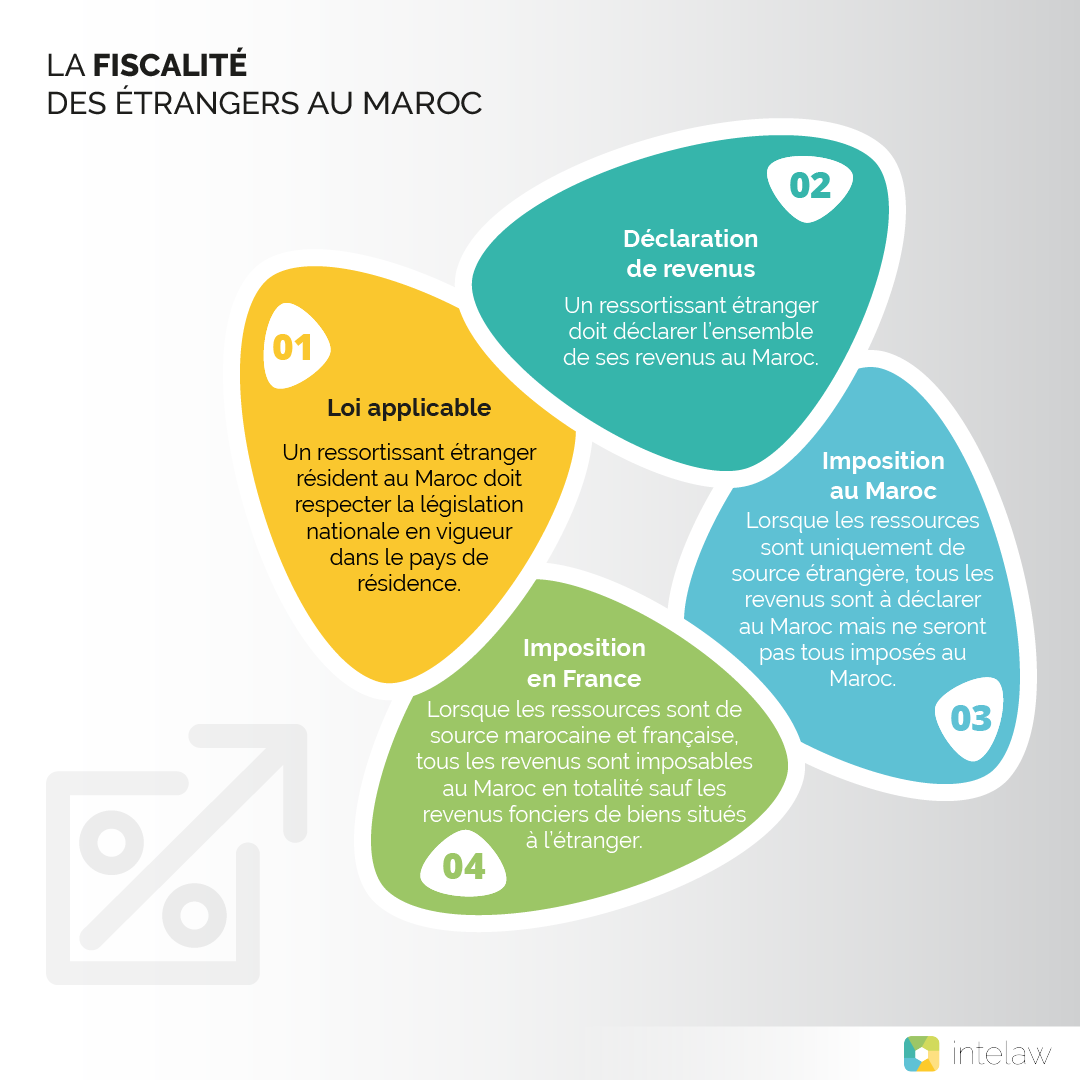

1. Applicable law: A foreign national residing in Morocco must respect the national legislation in force in the country of residence.

2. Declaration of income: A foreign national must declare all his income in Morocco.

3. Taxation in Morocco: When the resources are solely from foreign sources, all revenues are to be declared in Morocco but not all will be taxed in Morocco.

4. Taxation in France: When the resources are from Moroccan and French sources, all income is taxable in Morocco in all except the property income from property located abroad.